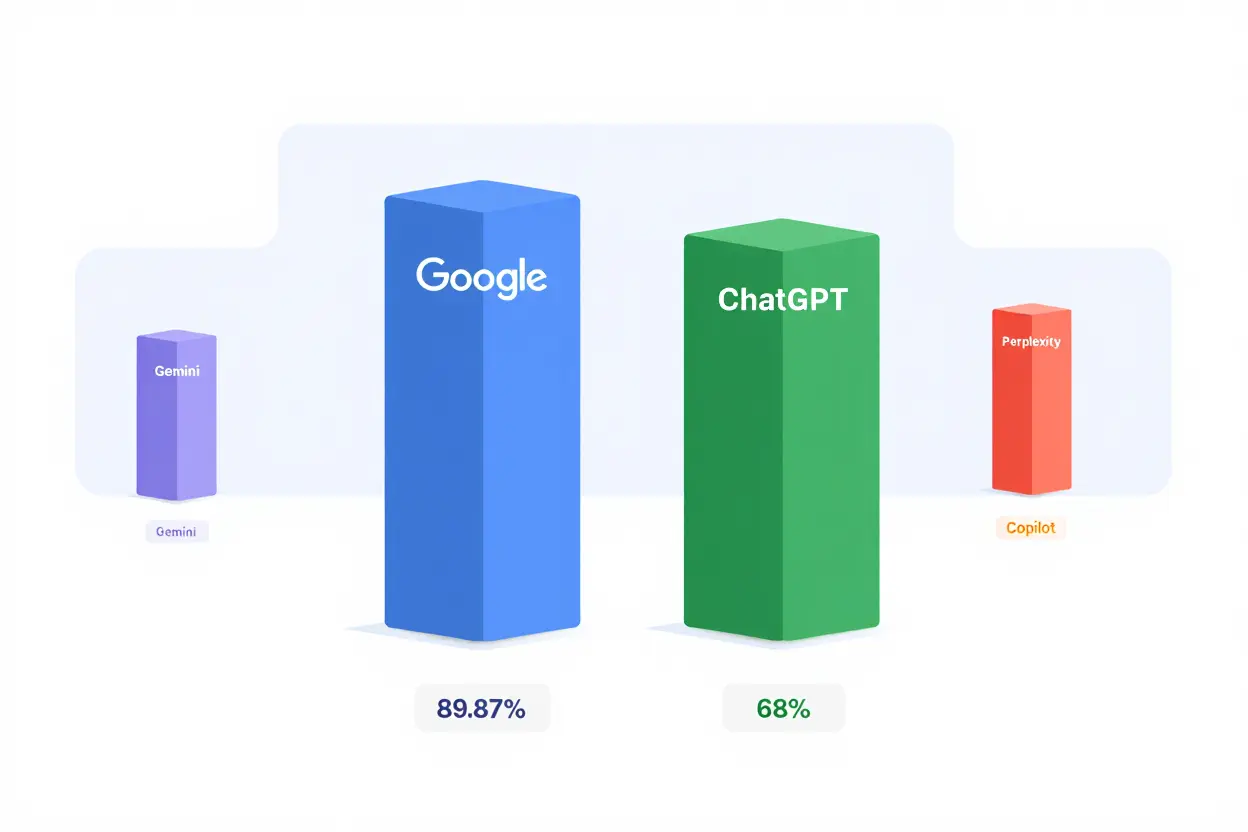

You're operating in a search landscape where Google still maintains a dominant 89.87% share of traditional queries, while ChatGPT captures 68% of AI chatbot traffic—a growing division that's reshaping how people find information. This article breaks down the key ai search market share 2026 metrics you need to monitor competitors and refine your approach. Learn where user traffic is moving, which channels impact market share, and how to optimize for both conventional SEO and ai-driven search.

Google vs ChatGPT: 2026 market share breakdown

The search ecosystem isn't collapsing—it's diversifying. Google retains firm control over traditional search, while ChatGPT builds a parallel conversational universe. Recognizing this split is crucial because users frequently switch between both platforms during a single research session.

Google maintains 89.87% search dominance worldwide

Google's dominance remains impressive, controlling 89.87% of the global search market share in 2026—only a slight decline from 91% the previous year. This near-monopoly covers both traditional keyword searches and emerging AI-enhanced queries, making Google's substantial presence the starting point for any ai search market share 2026 analysis.

Regional variations are significant. North America and Europe show Google above 92%, while emerging markets hover around 85%, leaving limited room for specialized competitors. The remaining 10% fragments across Bing, Neeva, and niche engines; yet the gap between Google and the next contender still exceeds 30 percentage points.

ChatGPT captures 68% of AI chatbot traffic

ChatGPT isn't just popular—it's becoming the benchmark. The platform commands 68% of global AI chatbot traffic, establishing the chatgpt market share within the broader conversational search market share distribution.

Google Bard maintains 18% of chatbot traffic, while Claude, Llama, and other competitors divide the remaining 14%. ChatGPT's advantage comes from longer session durations, support for multiple input types, and a robust developer network; recent quarters show a two-point increase, reflecting momentum from voice and image feature enhancements.

AI-search now represents 30% of total interactions

AI-driven search surged from under 10% of interactions in 2023 to 30% by 2026, marking a fundamental shift in query volume. Users increasingly perform dual searches—combining traditional Google queries with ChatGPT prompts—to complete the same task, pushing combined interactions beyond 100% of measured volume.

This hybrid behavior requires dual strategies: conventional SEO for Google and answer engine optimization for AI platforms. Mobile-first habits and younger demographics drive rapid adoption, with Gen Z and Millennials exceeding 70% usage rates, while enterprise adoption remains below 5%, indicating significant growth potential for ai search market share approaching 2026.

AI search engine market share leaders in 2026

According to the latest AI search ranking released in January 2026, the search market is highly concentrated, with three platforms capturing nearly 90% of all user interactions. Understanding where people go to search is crucial for optimization, and new data reveals how AI engines are dramatically reshaping the competitive landscape. Google, Microsoft Bing, and agile startups are all fiercely competing for traffic, search market share, and user adoption, aligning with projections detailed in the AI search market share 2026 forecasts.

ChatGPT and Copilot combined hold 73.9% share

As of February 2026, ChatGPT (excluding Copilot) attracts a dominant 60.7% of all AI search traffic, setting a high AI search benchmark. When you add Microsoft's Copilot share of 13.2%, their combined hold reaches a formidable 73.9%, creating a significant barrier for new competitors.

- Broad ecosystem integration: ChatGPT is deeply integrated across browsers, mobile apps, plugins, and third-party services, creating a seamless experience that keeps users engaged within its platform.

- Superior engagement depth: User sessions average an impressive 7.2 minutes, compared to just 4.5 minutes for its nearest rivals. This indicates stronger user stickiness and a tendency for multi-step research.

- Feature velocity: Quarterly market share gains of two percentage points reflect a steady stream of upgrades—like voice input, image analysis, and enhanced reasoning—that continually reinforce user preference.

The platform's market share continues to grow, fueled by deep enterprise integrations, superior conversation continuity, and precise reasoning. This solidifies its position as the default conversational search engine for both consumers and businesses.

| Platform | AI-Search Share | Key Strength |

| ChatGPT | 60.7% | Broad integration, 7.2 min avg sessions |

| Microsoft Copilot | 13.2% | Windows/Office ecosystem |

| Google Gemini | 15.0% | Gmail, Workspace, Chrome integration |

| Perplexity | 5.8% | Research focus, real-time sources |

| Claude AI | 4.1% | Long-context documents, enterprise |

Mid-tier players and vertical specialists emerge

While the top three players command a massive 88.9% of total search traffic, the competitive landscape still has room for mid-tier engines that focus on distinct specialties. The respective 5.8% and 4.1% shares held by Perplexity and Claude prove that significant market share exists beyond the giants in the AI search market share race.

- Perplexity’s accuracy focus: Its commitment to providing source-backed answers with citations makes it a favorite among academic and professional researchers who prioritize verifiable information.

- Claude’s document handling: Anthropic's Claude excels at analyzing lengthy documents like contracts, technical manuals, and policy papers, where a deep understanding of context is critical.

- Vertical specialists rising: Newer platforms targeting sectors like healthcare, legal, and finance are securing up to 25% of specialized queries by using models trained specifically for those domains.

- Long-tail fragmentation: Other players like Grok, Deepseek, Brave Leo, Komo, and Andi each hold ≤0.6% but successfully cater to privacy-focused or regional communities where alignment with user values is more important than a vast feature set.

For companies in regulated or specialized industries, it's wise to optimize for Claude, Perplexity, and other vertical engines in addition to ChatGPT. This strategy helps capture valuable long-tail search traffic while the mainstream competitors focus on volume in the broader AI search market share 2026 landscape.

How AI Overviews Reduce Traditional Search Traffic

Google's AI Overviews now appear in 18% of all Google searches and in 57% of long-tail queries. By providing direct answers right on the search results page, they satisfy user needs instantly, reducing the need for further clicks. This shift from click-based discovery to zero-click searches disrupts the economics that once fueled traditional SEO.

Zero-Click Searches Hit 43% Across Google Queries

Across all Google searches, 43% now end without any click to an external website—a figure that rises to 93% when Google’s AI Mode is active. This means nearly half of all queries are resolved on the results page itself, confirming that zero-click searches have become the norm. As a result, marketers are rethinking how search traffic moves from the search engine to their sites.

When an AI Overview appears, organic search click-through rates plummet. Pages that rank at the top for informational queries see their CTR drop from 1.76% to 0.61%—a decline of 61% for the same top ranking position. Fewer than 1% of users click on the links cited within the overview, so a citation offers little compensation for the lost traffic.

The AI overviews impact is even greater for complex queries. Long-tail, high-intent questions prompt the AI to synthesize answers from multiple sources, capturing almost all clicks. In contrast, transactional queries—like product searches—still see higher engagement because the overview often displays shoppable listings rather than descriptive answers.

Organic Click-Through Rates Drop 61% with Overviews

Analysts describe the effect of AI overviews on organic search as the most disruptive change since mobile surpassed desktop. Overall user click rates fall from 15% (when no overview is shown) to just 8% (when one appears), representing a 47% decrease in total clicks reaching publishers.

This decline is significant because many e-commerce and service businesses have built their growth strategies around Google organic search. A first-place ranking once delivered click-through rates of 20–30% on competitive keywords—today, that same top spot yields only 8–12%. For organizations that depend on search traffic, this creates an immediate revenue shortfall.

Gartner Forecasts 25% Search Volume Decline by 2026

Gartner predicts that overall search engine query volume will decline by 25% by 2026, as answer engines continue to gain popularity. This projection aligns with current user behavior: people are increasingly turning to conversational tools like ChatGPT, Perplexity, or Google’s own generative features instead of traditional search results.

Today, 29% of U.S. adults encounter AI-generated summaries during their daily browsing. Among high-income shoppers—a key audience for advertisers—adoption exceeds 40%. This group is already leaning toward conversational interfaces and paying less attention to standard results on Google.

Survey data reveal that 42% of people prefer using AI chatbots over a search engine for multi-step research. Hybrid search journeys—where users move between Google and ChatGPT—now make up 18% of all sessions. This illustrates a steady and accelerating shift of query volume toward conversational platforms and away from classic organic search.

User adoption and conversion trends for AI search

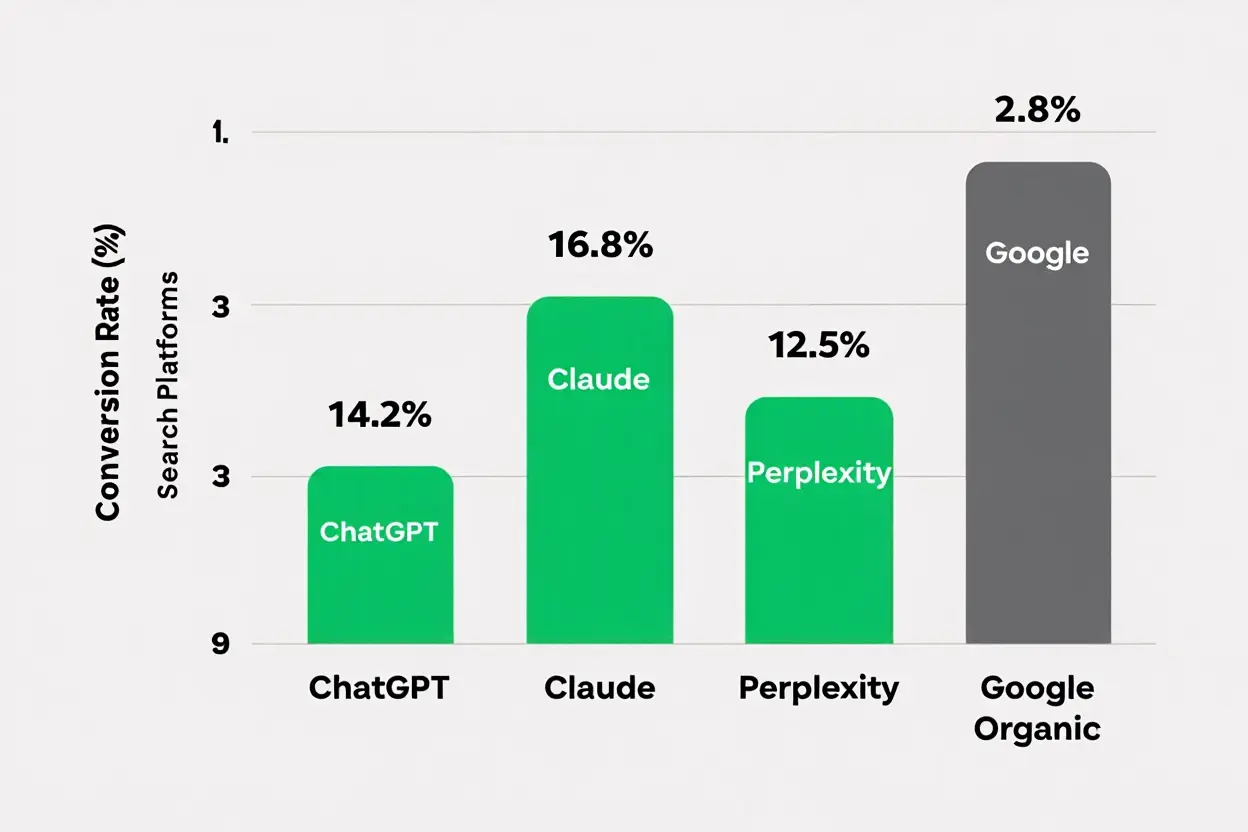

Traffic from AI platforms significantly outperforms traditional Google organic search in conversion rates. Referral traffic from ChatGPT achieves a 14.2% conversion rate, dramatically surpassing the 2.8% rate from conventional organic searches. This nearly five-fold increase in value per visitor is forcing marketing teams to completely rethink their budget priorities for 2026.

Monthly AI chatbot sessions reach 1.2 billion in 2026

Since 2024, AI chatbot sessions have been doubling annually, reaching an impressive 1.2 billion monthly visits and conversations by 2026. This explosive growth in user adoption trends clearly demonstrates that platforms like ChatGPT, Claude, and Perplexity have evolved from novelty tools into essential daily resources for discovery, creation, and decision-making.

- Mobile dominance: With 71% of chatbot sessions originating on smartphones, mobile optimization has become crucial for maintaining search visibility across all AI platforms.

- Daily active users growth: The number of daily active users on ChatGPT, Perplexity, and Claude has tripled within just twelve months, confirming their transition from weekend entertainment to indispensable weekday work utilities.

- Budget allocation momentum: Nearly 40% of decision-makers now allocate funds specifically for AI Search Optimization, while over 25% plan content strategies targeting AI citations—clear signals that AI and traditional SEO require distinct tactical approaches.

While adoption is still in its early stages, growth continues to accelerate, particularly among professionals aged 25-45 who increasingly rely on AI for market research, competitive analysis, and generating fresh insights. The rising monthly visit numbers strongly justify aggressive investment in AI optimization alongside classic organic search strategies.

AI-driven traffic converts 5× higher than organic

The substantial conversion advantages explain why forward-thinking brands are prioritizing AI search traffic. Visitors referred by AI platforms convert at an impressive 14.2% rate, while conventional organic search traffic languishes at 2.8%—delivering a five-fold efficiency improvement. Demographic insights reveal the most significant gains among affluent, college-educated users who conduct thorough research before making purchasing decisions.

A recent case study highlights the potential: ChatGPT referral traffic generated 12,832 visits, resulting in 127% more orders and $66,400 in direct revenue. Claude currently delivers the highest conversion rate at 16.8%, closely followed by ChatGPT at 14.2%, both dwarfing returns from ordinary Google searches and traditional organic search channels.

Mobile and younger demographics lead AI adoption

Generation Z and Millennials demonstrate over 70% adoption rates for AI-first search, confirming younger demographics as the earliest adopters. More than 60% of 18- to 34-year-olds prefer conversational AI for product research, favoring interactive dialogue over static search results.

- Mobile-first behavior: Smartphones drive 71% of all chatbot sessions, making mobile-optimized content essential for capturing both search traffic and referral traffic effectively.

- Income-based adoption: High-income shoppers encounter AI-generated summaries more than 40% of the time, demonstrating that premium audiences increasingly turn to AI for purchase decision support.

- Hybrid search patterns: Many users regularly switch between Google searches and AI chat within the same task, indicating these channels complement rather than compete with each other.

E-commerce and SaaS companies that optimize concise answers, structured data, and clear value propositions for AI extraction will successfully capture these fast-growing demographic segments. Aligning content with conversational interfaces ensures both immediate conversions and long-term search visibility across ChatGPT, Claude, and emerging AI tools.

Optimizing for AI Search Engines: AEO Strategies

Answer Engine Optimization (AEO) moves beyond classic SEO by shifting focus from Google's ranking algorithm to language models that extract specific information. The goal is no longer just to get the top blue link but to become the trusted source that AI-driven search systems reference within their generated answers, significantly boosting your search market visibility and overall market share.

This guide explores how AI-powered SEO tools and autonomous agents can automate keyword discovery, competitor analysis, predictive content modeling, and schema implementation. The ultimate aim of these tactics is to grow your AI search market share on new platforms before 2026 by capturing more traffic from both traditional search engine results and conversational answer boxes.

Structure Content for AI Citation and Extraction

A successful answer engine optimization strategy requires a new approach to content structure. AI models favor concise, self-contained snippets instead of long articles. Build each page around clear questions and provide a direct 40–60-word answer right under the heading. This makes it easy for models like Gemini and ChatGPT to quote you directly.

- Concise Answer Placement: Provide the main answer within the first 40–60 words, matching the snippet length most language models use for their summaries.

- Scannable Formatting: Use bullet points, tables, and short paragraphs so AI systems can quickly identify and extract key data without parsing dense text.

- Entity Optimization: Focus pages on specific entities—like products, concepts, or people—and clearly list their attributes and relationships. This increases the range of queries that may lead to your content being cited across various AI-driven search environments.

This method differs from traditional SEO, which often prioritizes long-form storytelling for human readers. AEO content must still engage and satisfy users to build trust, but it also needs to be easily machine-readable to increase how often it's referenced across multiple answer engines.

Implement Schema Markup for AI Crawler Visibility

Schema markup turns plain text into structured, machine-readable data—a core component of any AEO strategy. Use JSON-LD types like FAQPage, HowTo, Product, Review, and Article to help crawlers instantly understand your page’s content and accurately pull answers.

Follow a clear heading hierarchy—H1 for the title, H2 or H3 for questions—and validate your markup with Google’s Rich Results Test to avoid errors that might prevent extraction. For large sites, automate schema deployment to ensure consistent implementation across thousands of URLs. This improves citation accuracy on platforms like Google Gemini, ChatGPT, Perplexity, and others simultaneously.

Measure Citation Frequency and Answer Inclusion Rate

Success in AEO is measured not by keyword ranking but by how often your content is cited across platforms such as ChatGPT, Google AI Overviews, Bing, and Perplexity. Track metrics like Featured Answer Impressions and Answer Inclusion Rate to gauge how frequently your content powers generative replies and drives traffic.

Correlate spikes in citations with conversions—like form submissions, sales, or sign-ups—to demonstrate ROI. A single page cited in 100 ChatGPT responses per week can direct a substantial flow of visitors, so it's important to monitor which formats, topics, and engines deliver the best results.

Establish collaborative workflows between content, engineering, and SEO teams, supported by dashboards that highlight technical issues and content gaps. AEO works alongside traditional backlink-focused Google ranking strategies, allowing brands to capture market share across both the vast traditional search market and the fast-growing AI search market share dominated by answer engines.